When you think about personal finance bloggers what words come to mind? Thrifty? Penny pinchers? Vouchers?

Why should personal finance always be about penny pinching. I hate it and its no fun! For some reason when people start thinking about personal finance it’s always about how can I save 5p here and how I should downgrade all my shopping to the value versions that taste like dirt. It just never sounds like anything that you would want to do. It also makes it feel like hard work and a sacrifice to save money and this should never be the case. Why should you make more effort to think about buying something that you are going to enjoy less just to save a small amount of money? and before you start throwing phrases at me like “Look after the pennies and the pounds will look after themselves” I get it, but its never going to be the way to make significant amounts of money. Now I agree that if you can pick something up for cheaper than you would normally expect to pay then great, take the saving and move on but I for one do not want to downgrade my standard of living to any great extent just to save £10 here or there. I am a firm believer that as long as you can prove that you can afford something you should never feel guilty about spending the money to get something you want. You just need a plan……

Where people tend to go wrong is by spending what they want, when they want without thinking about what the effect will be on their bigger financial picture. They then act surprised when they have no money to buy food with pay day still a week away. This is where finances can quickly start to get out of control. Some people seem to think that controlling your finances is boring and that spontaneous spending is the only way to have fun and I kind of agree, but only so far as saying that spontaneous spending is fun, when you know your not going to go broke after you’ve done it. The number of times I hear “I can’t wait for pay-day, then I’m gonna go out and spend spend spend” or “pay day was 3 weeks ago and I’ve run out of money, I shouldn’t have gone out and bought all that stuff the other week”. These are the words and thoughts of people not in control of their money.

There are many tricks and ways to control your finances and I am going to talk about one of the most fundamental and simple forms that you can start to use straight away. A spending plan, you may know this as a budget but I don’t like to use that word. It feels too much like you are limiting yourself and puts a negative spin on the whole experience. I feel calling it a spending plan is a bit more realistic and acknowledges that fact that there are things you have to spend money on to live. Remember, this isn’t about cutting, its about planning.

There are loads of examples around of spending plans and you can pick and choose if you want to use one that is ready made for you, but I find the best way to fully understand it, is to create your own, just on a simple Excel sheet. You will need a recent bank statement and any other information you have about any regular payments or commitments you have.

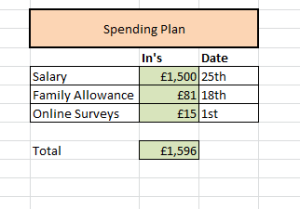

Start with your money in, this may be your monthly salary, weekly wage or if you have an unsteady income, try and come up with a monthly average estimate of what you bring in. I always think working monthly is the best place to start as this matches most peoples form of pay and also matches most expenditure methods we have as well, such as rent, mortgages or phone bills. Make a note also of what date your income lands in your account, this is really important as this will drive all your other decisions from here. Add any other forms of income you may have to this section and you should end up with something like this:

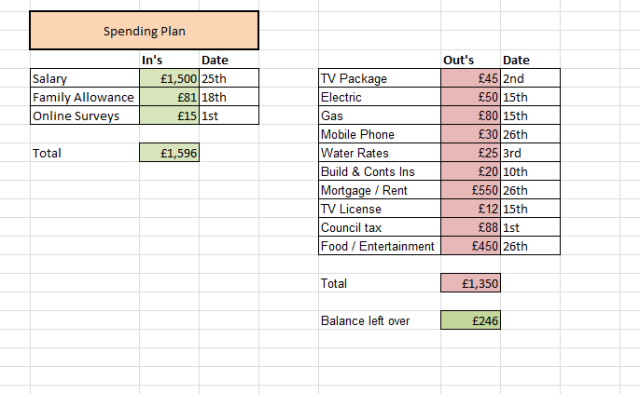

OK, so now have a think about all your bills and outgoings. Just work on the vital things first like rent, utility bills or any debt repayments etc. Again, make a note of what date in the month these tend to go out. This date may be flexible by a few days so try and pick the earliest date so you don’t get caught out. Now have a think about how much you spend on food and entertainment (like going out for drinks or the cinema) If this is too difficult, then try and monitor yourself for a week. Take a small note pad, or use the notes app on your phone and overtime you spend some money on food, just make a quick note of it. If this is something you haven’t done before, then you may be in for a shock when you realise how much of our money disappears on food and drink. Just measure yourself for an average week and see what it comes to. Divide your weekly total by 7 to get a cost per day, and then times that daily total by 30 to get an average spend per month. The “outs” section of this sheet is always going to take longer than the In’s section so take you time and maybe complete it over the course of a month to ensure you collect all the information.

Once you have all your In’s and Out’s this should now provide you with an amount of money that you have left over once you have paid for all the basic things you need to live. This amount of money left over will now help you make decisions on all sorts of things, like savings, investments, or just putting a little bit aside for some guilt-free spending.

By doing this exercise you are putting the control back in your own hands, you can see in a standard month where your money is going and what you should have left over if nothing unexpected or spontaneous happens. From that amount you have left over, you should now open a standard savings account (instant access) just so you have somewhere separate to store some money short term. You should be able to do this with your current bank at no cost, most banks will enable you to set this up online really easily. Call this your guilt-free account and put as much or as little as you want in it, but do not exceed what your spreadsheet says you should have left at the end of a standard month. You can now dip into this account whenever you want and never feel bad about what you have spent. You have also ensured that what ever you spend from that account has not impact on all your other bills and even if that account runs dry, you will still be able to meet all your commitments and not get evicted.

If your leftover number is bigger than expected you should definitely think about setting up a proper saving or investment account, but I will deal with this in a later post.

Come back soon for the next step: Scheduling your financial life.

Happy spending

R